Inflation is trending down, and interest rates are likely to follow

Since the aftermath of Covid, we have become used to high inflation and rising interest rates. Last year saw a stabilising of the situation, and now it seems inflation is pretty much under control within the EU, and the first reduction in interest rates by the ECB is upon us.

The European Central Bank has confirmed that the average level of inflation within the European Union has currently fallen to around 2,4% - a very respectable figure and a far cry from the more than 5% recorded just a few years ago. In fact, the present rise in the cost of living is within what can be considered to be a ‘normal’ range, even if interest rates are still above what we have been used to for the better part of 20 years.

Yet there is relief on the immediate horizon, as the first of what are likely to be two rate reductions by the ECB is scheduled to take place in June, with the second later in the year. In all, European interest rates are expected to drop 1-1,5pp by the end of the year, and in that sense we are more fortunate than the UK and US, where inflation still stands at 3,4% and 2,8% respectively, and where the rate drops will come later in the year and likely fall by less.

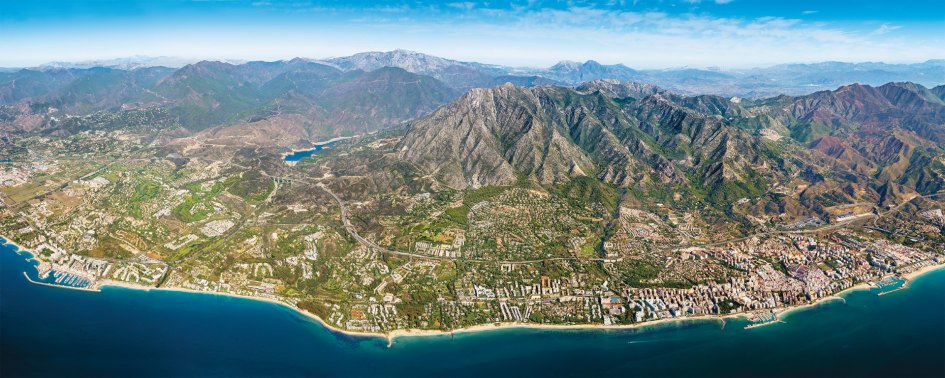

Impact on the economy and the Marbella property market

Spain is one of the top economic performers within the EU right now, but it also has relatively high inflation, at 3,3%. Thanks to the fact that the overall level in the EU is lower, we will benefit from the drop in interest rates that is expected to stimulate investment and economic growth in the near future and will certainly do so in Spain too. In all, inflation is trending downwards within the country too, albeit in line with a more dynamic economy than some in Europe.

What we have, then, is an environment in which price growth is slowing down, the nationaleconomy is still strong, and interest rates are beginning to come down and make borrowing and investing easier. On a national level, construction costs and houses prices have largely levelled off, and on the Costa del Sol and the Málaga region, booming tourism and a strong property and building sector are driving growth amid solid price growth.

The conditions are therefore favourable, and the fact that the rate of increases in house values is also diminishing a little, is actually a good sign, as it staves off the dangers of a property bubble, an issue that does appear to be a threat in the near future. In all, the confluence of factors could be a lot worse – in actual fact they are really quite favourable, and while there is always the danger that inflation could rise again or the economy could slow down, for now the mix favours the market.

Discover the insights that shape the world of ultra-high-net-worth individuals (UHNWIs) with Knight Frank’s flagship publication,The Wealth Report.

Pia Arrieta, 10 May 2024 - News

Related Articles

Knight Frank Global Super-Prime Intelligence Q2 2025: Global sales surge by a third

2 min. read · Pia Arrieta

The impact of foreign property buyers in Spain

6 min. read · Pia Arrieta

Top emerging areas in Marbella

5 min. read · Pia Arrieta

Knight Frank: Prime Global Cities Index, Q2 2025

2 min. read · Pia Arrieta