Marbella Real Estate Market Report 2024 – 2025

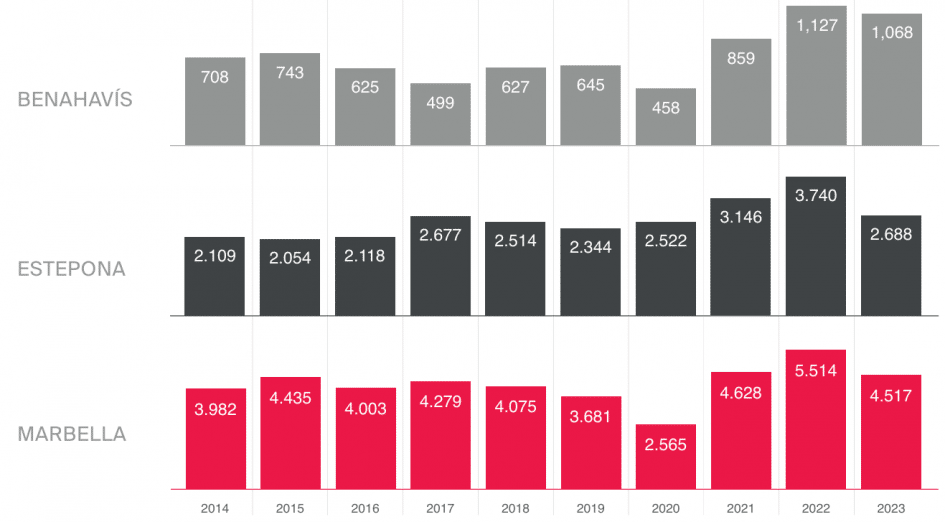

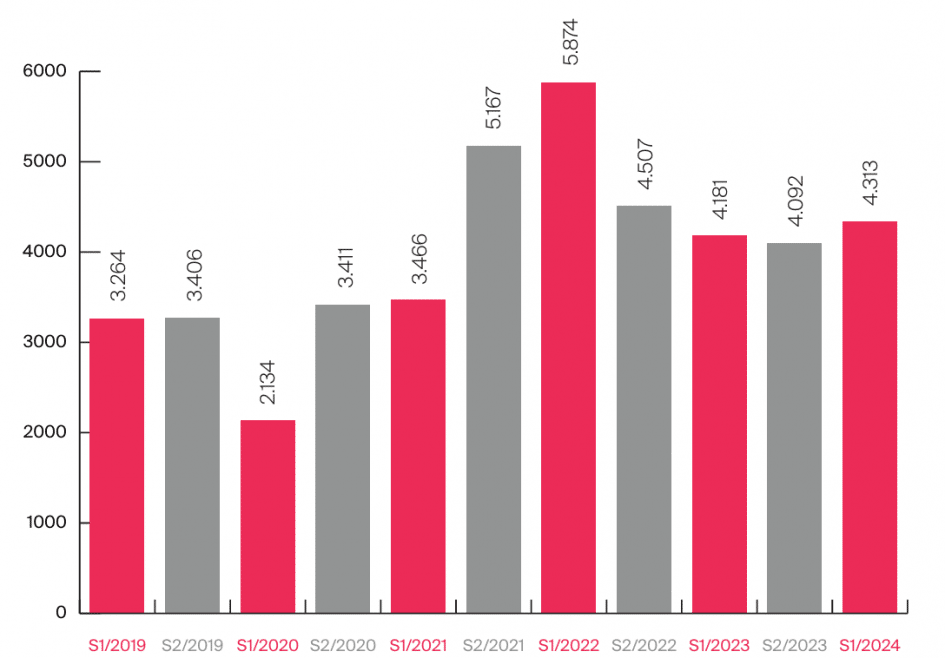

The economy, and locally the demand for Costa del Sol property, had been in strong recovery mode since around 2014, but after the initial shock to the system caused by the Covid lockdowns, the market surged back in 2022 like never before. It was as if a dam burst. There was naturally a certain amount of pent-up demand that had built up during 2020 and 2021, but it cannot explain the wave of buyers that suddenly flooded the market in 2022 and made it the best year on record.

The distancing experience enforced upon us during Covid truly thrust the world into an environment of remote working and online communication that opened up the possibility to live further from ‘the office’ and pursue quality of life. Many did just that and Marbella and surrounding areas were perhaps the most popular places to come to, resulting in a record-breaking 2022 where the combination of sales transactions and average price set the bar very high.

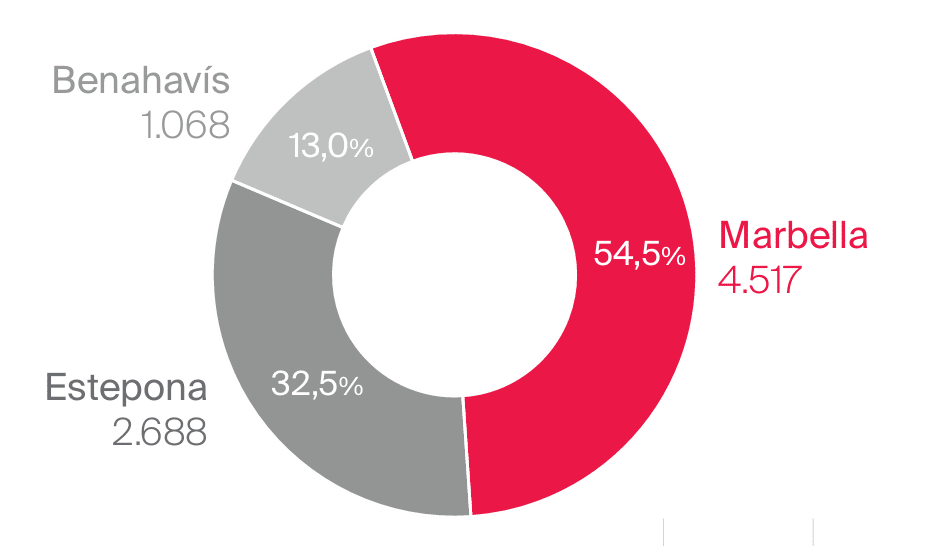

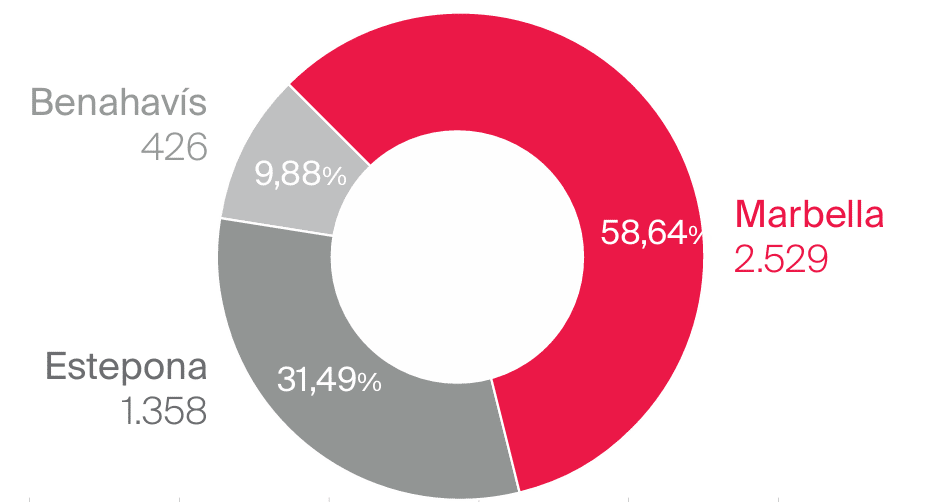

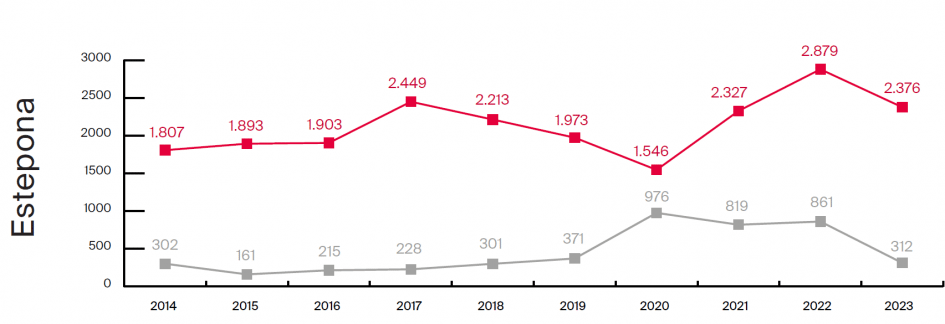

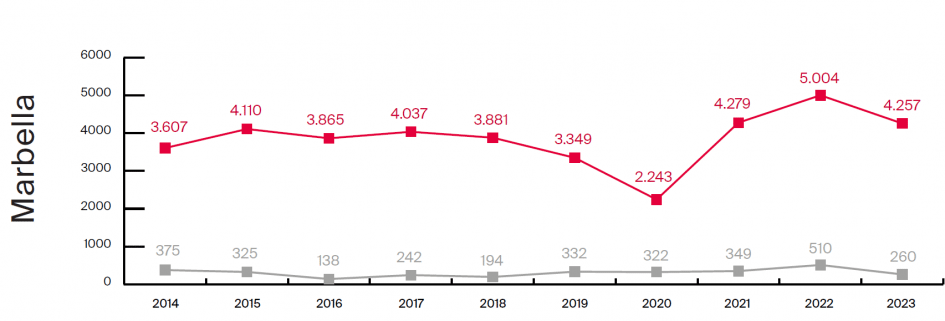

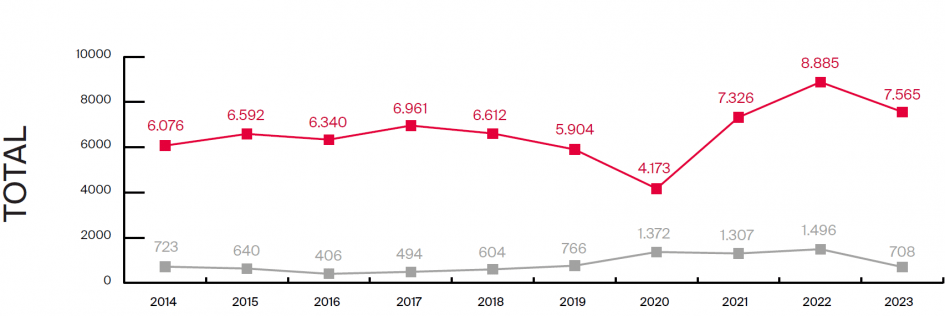

Though sales dropped by around 20,31% in Marbella, Benahavis and Estepona combined (Source: Fomento) in 2023, the effect continued, and the market went from exceptional to very good.

If 2023 was still bustling, what could be expected from 2024? Well, warnings that the world was about to head into recession mode have not really come true. The UK and Germany have flirted with recession but most other countries, including Spain, continue to grow. On the Costa del Sol it is business as usual for tourism and the property sector, with another bumper summer tourist season and continued high demand for homes.

Sales Evolution Trends

A healthy and resilient real estate market.

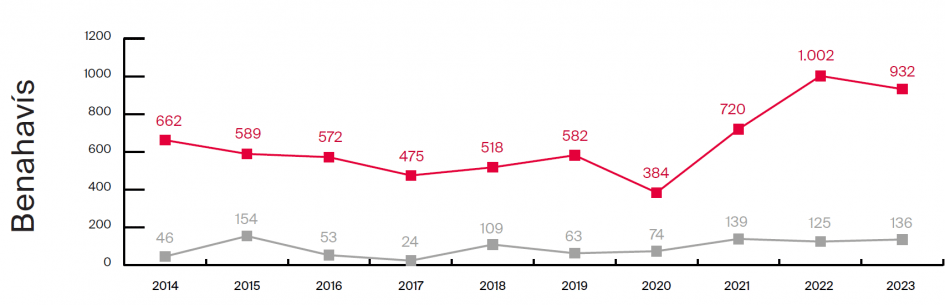

In Spain, as well as in the Golden Triangle (Marbella, Estepona and Benahavís) sales were down last year by 9.8% and 20.31% respectively. According to official figures (Source: Registradores and Fomento), the number of transactions in our area dropped from 10,381 to 8,273 - but this is mostly because 2022 was such an exceptional year, so in spite of the drop, 2023 remained a good year with a high level of transactions.

Sales figures remained strong in the first half of 2024. In the Golden Triangle, transactions were 5.4% higher than in the second half of 2023.

Marbella saw a notable increase in sales, rising by 13.92%, while Estepona experienced a slight increase of 1.65% and Benahavis dropped significantly by 20.52%. These fluctuations are often influenced by the availability of new stock, though resales continue to make up the majority of transactions, with new builds growing both quarter on quarter and by comparison with the same period last year.

According to the most recent official figures from Q2/2024, sales in the Golden Triangle grew year-on-year by 6.98%, indicating a healthy and resilient real estate market.

Let’s look at some of the trends behind the figures. The statistics bear out that Andalucía remained the most popular region in Spain, and within it Málaga and the Costa del Sol were the most dynamic markets, driven by foreign buyers (about one in three in Málaga province) and the higher-end segment, with resale properties representing just over 90% of all purchases in the greater Marbella area.

Most popular property types

The popularity of villas as a property type within the Golden Triangle, and to a lesser extent the Costa del Sol in general, is disproportionate to normal market conditions and is directly attributable to the fact that this is a luxury destination.

Even so, apartments, especially within upmarket gated complexes with resort facilities, still form the main backbone of the local market, with townhouses less popular than they once were but semi-detached villas having made something of a comeback as they offer a good alternative to stand-alone villas in terms of space, private swimming pools, gardens and garages, but at a lower price.

In recent times, the trend towards compact modern villas has reversed a little, as post-Covid, more buyers now seek space and privacy within larger properties with bigger private gardens.

New Build or Resale?

In 2023 there were a total 8,273 properties sold (new build and resale) in the municipalities of Marbella, Benahavis and Estepona. Of these, 7,565 were resale homes, which represented no less than 91% of all sales, a clear indication that resales continue to dominate the market in the area.

That said, new builds remain an important driver in the market, supporting not only a thriving construction sector, but also appealing to a lot of new buyers to the region.

When looking at Málaga province as a whole, the percentage of new build properties sold in 2023 was much higher than in the Golden Triangle.

% New build over total sales Malaga province: 19.41

% New build over total sales Golden Triangle: 9.3(Source: Ministerio de Fomento. Figures represent sales of new build units completed)

Belgian, Dutch and Polish buyers have a particular taste for newly built properties, with almost one in four choosing this option, and the areas with the highest concentration of new-build sales are usually the ones with more land available for such projects.

New construction starts

As we speak there are reported to be 374 new developments on the Costa del Sol and Málaga, with about 170 concentrated within the main part of the coastal region near Marbella, and the largest number in Estepona. New build villas and apartments are in high demand because of the styling, technical infrastructure and amenities they offer, yet even so in 2023 they represented less than 10% of total sales in the Golden Triangle.

Supply versus Demand

Until recently, demand for newly built homes on the Costa del Sol was such that supply struggled to keep up. A large percentage of buyers want key-ready properties that are not just built, snagged, landscaped and decorated, but equipped right down to the bedding, cups, saucers and cutlery. In other words, ready to enjoy.

Many such projects were sold entirely off-plan, before construction even began. This process has started to slow down a little, with some phases now being sold during construction but generally before final completion and delivery. Over 2022, the amount of available stock was reduced by 11%, with another 8% reduction over 2023.

Construction costs

One of the factors that has come to greatly influence construction is cost, the other being delays. Inflation shot up in the aftermath of the Covid period, when shortages and supply chain delays destabilised the world for builders, project managers and developers alike, pushing costs up, creating delays and ultimately adding to the rising prices of properties.

It became hard to manage budgets, as the price of materials and other supplies rose so quickly that providing closed quotations for construction was near impossible. The cost of construction could therefore have risen considerably from the beginning to the end of a project, added to which were delays caused by shortages of materials, equipment and qualified staff.

Teams are also being enticed off-site by rival projects, a repetition of the situation during the last boom of the 2000s. Fortunately for the sector, price increases began to slow down and then level off during 2023, but contingencies for increases and build delays should still be made in a market where build prices per m2 have risen from €1,500-€2,000 a few years ago to €2,500-€3,500 now.

New construction trends

The years after the financial crisis of 2008 ushered in a new period of modern architectural design that also focused on a greater degree of technology, especially in the form of home automation systems. The construction methods, however, remained largely unchanged, yet now – as a result of the factors described above and a drive towards more (energy) efficient and environmentally friendly building and homes, new techniques that are already common in regions such as Northern Europe (for instance, prefabricated structures) are beginning to make inroads into the local market.

In an era where banks no longer provide the initial financing for real estate projects and interest rates are now easing again from a high point, the need to reduce building costs, offer buyers a more sustainable option and speed up the construction process makes solutions such as prefabrications highly attractive. What’s more, they result in cleaner building sites and do not limit architectural or other creativity, and together with a range of other alternatives appear to represent a more high-tech future for building on this coast.

Supply

Most popular areas

The most highly desired areas, such as the Golden Mile, have to some extent become the victim of their own success, in this case registering fewer sales than in recent years, most likely due to the fact that prices per square metre here are beginning to rival those of major urban centres such as London and Paris. These high prices, in turn, were caused by the excess of demand over what is limited supply these past five years – a factor also seen in other prime areas, but one that is most acutely felt on the Golden Mile, where the rapid rise in prices has put properties especially in locations such as Marina Puente Romano beyond the reach of even many affluent buyers.

The space, privacy and security of La Zagaleta continues to exert a strong pull among top-end buyers, while nearby El Madroñal, which suffered a drop in popularity for a while, is back in favour, with its country villas being modernised and new ones built. A new country club that is also in hot demand for both villas and apartments is El Real de La Quinta, while the likes of Sierra Blanca, Nueva Andalucía, Guadalmina and Los Monteros remain classics.

Fastest-growing areas

The above classics are also increasingly joined by upcoming high-end addresses such as Los Flamingos, El Paraíso and the aforementioned El Real de La Quinta. In that regard, there are no surprises, only a continuation of existing trends, though strong demand over the past three years in El Paraiso has seen many of the older properties renovated and modernised, either by homeowners, buyers or investors. In this regard, it has followed in the footsteps of Nueva Andalucía. Meanwhile Los Flamingos has been gathering increased demand with many of its plots being sold off in the last 3 years. Although a few plots still remain and the area has yet to establish itself, it is well on track.

In a market where buyer demand is strong and particularly focused upon new modern homes, construction will always play an important role. A buoyant building sector is in general an indication of a growing economy, and if gauged this way the Costa del Sol is in good health. Due to the limited availability of readily available buildable land, planning issues that remain unresolved (a decade on) and delays in issuance of building licences, much new development has moved from Marbella to Benahavis, Estepona and also Manilva, Ojén and Mijas who are drawing in most investment thanks to more functional urban planning directives and shorter waiting times for building licences.

Estepona, both to the east and west of the town, has benefitted from the availability of land and the greater ease of obtaining building licences than is the case in Marbella, and as result it has been in the spotlight of developers for some years now, with new projects coming to life and forming the backbone of new real estate on the coast.

New Urban Plan

After years, the Marbella Town Hall granted initial approval of the general Urban Development Plan (Plan General de Ordenación Urbana 'PGOM') earlier this year. A whitepaper that lays out the design for the city's planning model and whose final approval is expected in early 2025. It will be followed by the Urban Development Plan (Plan de Ordenación Urbana 'POU'), which includes the detailed urban planning and is expected to be approved within the next two years.

If successful, this long-awaited document will pave the way for the legalisation of thousands of properties with a hitherto ambiguous status, as well as provide clear guidelines for future development and the obtaining of building licences. In other words, a normalisation of the urban planning situation that will end Marbella’s disadvantage with regard to other towns on the Costa del Sol.

Buyer Profile

Buyer Nationalities - UK still strong

Foreigners accounted for almost 15% of the property market in Spain and Andalucía in 2023, and around one third (33.71%) of the buying public in Málaga province. While there are no official figures, we would suspect that this percentage rises dramatically in areas such as Marbella, Benahavis and Estepona, the so-called Golden Triangle. Despite their declining share in recent years, British buyers still top the table in Málaga province (15%), followed by the Dutch (8%) and Swedes (8%).

The main new geographical markets that have come up over the past year or two are, above all, Poland - a country with a great deal of unharnessed potential - the Czech Republic and to a lesser extent Romania. To this could soon be added Slovakia, Hungary and the former Yugoslav republics, with the Russian market slightly reviving (though not so much within the oligarch level), and of course there has been a wave of Ukrainian buyers and renters since the beginning of the war.

Meanwhile, traditional markets such as the Norwegian, Danish, Irish, French, German-speaking and Arabic markets also remain significant. Also not insignificant are the Italians, though seldom spoken of, with middle to upper end Moroccan buyers also strong over the past few years and now also increasingly joined by a growing wave of interest from North America, whose buyers in a short period of time have come to make up almost 2% of buyers on the Costa del Sol, and probably more within the more urban market of Málaga city.

Based on our own sales, British buyers topped the ranking, with Poles and Ukrainians in second place followed by Belgians, and then a very wide range of nationalities.

Percentage of foreign buyers in total property purchases:

In 2023, 15% of the homes purchased by foreigners in Andalusia had a price of over €500,000

Getting younger and younger

It is well documented now that the average age of buyers has been dropping for some time, especially in the wake of the post-Covid remote working and digital nomad revolution. More and younger people are coming to the Costa del Sol not just to spend a few weeks in a holiday home, but to live and work year-round, put down roots, with their children at local schools. Added to this is also a kind of ‘staycation’ that involves stays of several months at a time, but taken together it is a trend that is impacting the market, affecting the size and facilities homes are now expected to offer, and putting serious year-round strain on the local infrastructure of roads, parking, water supply and overall amenities.

According to Knight Frank’s European Relocation Survey, Digital Nomad visas have become the most popular route for those relocating, with 36% opting for this flexible work option. Millennials and Gen Z, in particular, place a higher emphasis on employment and education. Marbella, with its cross-generational appeal, ranks as the third most preferred resort destination for Millennials, highlighting its growing popularity among younger, professional buyers seeking both lifestyle and career opportunities.

Global Connectivity Driving Market Growth

Direct flights are vital in boosting tourism and attracting international buyers and entrepreneurs to the region. Málaga Airport connects to 158 destinations across 35 countries, including key cities in the UK, Germany, France, and Scandinavia. With record-breaking passenger numbers and a top-five ranking in Europe for private flights, its seasonal Málaga-New York route is expected to operate year- round soon. This robust connectivity makes Málaga and the Marbella area ideal for those seeking a dynamic and well-connected lifestyle.

Price Evolution

Strong demand, prices continue to grow.

In the wake of strong demand and high sales levels, prices continue to grow, not just on the Costa del Sol but throughout large parts of Spain – now for the ninth year in succession. During 2023, they rose 5.3% nationally, 5.8% in Málaga province (Source: Registradores), and more within the Golden Triangle (Marbella, Estepona & Benahavis), though the rate slowed slightly compared to 2022.

Even so, according to the asking prices registered by Spanish property portal Idealista, prices increased by 7.5% in Benahavis, 19.3% in Estepona and 18.6% in Marbella in 2023. In spite of all of this, there seems to be no immediate danger of a bubble developing, as supply, demand and prices appear to be well-matched at the moment.

In the first half of 2024, property prices in Spain, Andalucia, and Malaga showed varied trends, according to Land Registry’s Office data. Nationally, prices grew 2.25% year-on-year, while Andalucia had a 4.55% increase. The province of Malaga stood out with an average year-on-year increase of 8.05% for the semester. Malaga ranked as the 6th province in Spain for price increase and 5th in number of sales during this period, highlighting the province’s strong market performance.

In the Golden Triangle, prices continued to grow steadily. Lacking public official data for sales prices locally, asking prices on property portals serve as a reference for market performance. By June 2024, according to Idealista, the average prime price in the Golden Triangle was 4,229 €/m2, showing a year-on-year increase of 11.13%.

Impact of Interest Rates

Over the past two years, the central banks in large parts of the world, notably Europe, the UK and US, have responded to rising inflation by raising interest rates. In Europe, in particular, inflation is now almost back to pre-Covid levels (though still a little more persistent in the UK and USA), and as a result the ECB is now expected to introduce two sets of cuts this year, the first of which came in June, with a drop of 25 base points.

Even so, it has to be said that even high interest rates have done little to stem the flow of buyers and investors on the Costa del Sol over the past two years. This can be explained by the fact that a large proportion of them are not dependent upon mortgages and only tended to make use of them when rates were attractively low.

Market Trends

We have seen that construction costs are beginning to slowly level off, along with the cost of land (frequently ranging between €300-€1,500/m2, depending on location and whether the land is ‘bare’ or already includes a project with pre-planning), where home prices are still growing. Overall, inflation has slowed considerably, and interest rates are expected to gradually drop in response to this, which will have a positive effect on a market that is in any case not too dependent upon mortgages.

That said, after a somewhat sluggish 2023, the issuance of mortgages has risen by an impressive 15.3% across Spain in the first quarter of this 2024, a factor that is not so easy to explain, given that interest rates have not yet dropped considerably, and home prices continue to grow. However, the fact that the Spanish economy has been growing considerably in recent times, unemployment is at its lowest level in many years and household incomes are growing could be the reason behind this recent spurt in borrowing for home purchases.

What 1 Million € gets you

Comparative values in the Golden Triangle (Marbella, Estepona, Benahavís)

How many square metres of prime property does 1.000.000€ buy you in:

(M): Marbella - (B): Benahavís - (E): Estepona

Relative values

How many square metres of prime property US$1m buys in selected cities.

(Price per square metre in Marbella is for prime property in A+++ locations)

Consumer Trends

Demand for modern, sustainable, quality living.

Where once the expectations foreign buyers had of their Costa del Sol holiday homes were low – in keeping with purchase prices that were proportionately cheap - there has been a consistent increase in build quality and accompanying amenities, culminating in the fact that people now expect modern styles and amenities, home automation systems and a long list of community facilities.

This is naturally especially true of recently constructed villas and apartments, whose developers are increasingly aware that they have to include not just style, comfort and location, but also security and the starting point for the kind of lifestyle that draws people to these shores. This includes gated communities with 24-hour security, on-site leisure facilities that now extend beyond gardens and swimming pools to also include gyms, heated indoor pools, spas and even co-working areas, concierge/ reception and café/chiringuitos. As a result, many a Costa del Sol urbanisation is becoming nothing short of a residential resort.

Another factor that has gained increasing importance in recent years is sustainability. Though often used as a somewhat hollow marketing cry, buyers now do respond to projects that can offer the lower maintenance costs and environmental credentials of good energy efficiency, environmentally certified construction and management, as well as a living environment that embraces nature and offers quality of life as well as amenities. After all, this is one of the key reasons why people come to the Costa del Sol, and a property or a development with BREEAM or Passiv Haus credentials has more credibility with buyers.

What buyers want

- Branded Residences

- Co-working areas

- Resort-like facilities

- On-site leisure amenities

- Properties ready to-move-into

- Gated communities with 24h security

- Sustainability and energy efficiency with environmental certifications

Another major trend continues to be the Branded Residences, in reality a cross branded project between a developer and a luxury brand, some offering concierge services and amenities while others offering only a styling or architecture design by the “Brand” with no additional services. Currently, there are quite a few being developed and marketed, showing a rapid rise in a short period of time.

- Epic Marbella by Fendi Casa: 56 exclusive apartments and sky villas, the first in Europe developed with Fendi Casa, offering top design and luxury amenities. All phases are now complete.

- Karl Lagerfeld Villas: A collection of five luxury homes on Marbella’s Golden Mile, combining modern design and sustainable materials, with access to the Epic sports and social club. Expected completion by the end of 2025.

- Marbella Design Hills - Dolce&Gabbana: A luxury development of 92 residences in the heart of Marbella’s Golden Mile, featuring amenities like wellness facilities, shopping, and concierge services. Completion is planned for the end of 2027.

- Elie Saab Villas: Five luxury villas in a gated Sierra Blanca community with sea views, private gardens, infinity pools, and interiors designed by Elie Saab. Estimated dates: Not confirmed yet.

- Angsana Real de La Quinta: Banyan Tree Group’s first project in Spain, featuring a 90-room hotel, residences, restaurants, and nature-focused amenities in Benahavis. Completion expected by the end of 2026.

- The Gallery by Minotti: A gated community of 33 luxury villas near Marbella, offering 5-star resort amenities and panoramic views. Completion is set for phases ending in 2024.

- Wyndham Grand La Cala: 58 modern townhouses in a gated frontline golf complex with wellness and co-working centres, just minutes from the beach. Estimated completion by the end of 2025.

- Tierra Viva: 53 ultra-luxurious villas inspired by Lamborghini, located in the hills of Benahavis, some featuring car lifts. Completion set for 2027.

- Marea Interiors by Missoni: 65 luxury apartments located in Finca Cortesín, in a gated community with completion scheduled in phases from 2024 to 2027.

- Versace Villas: Eight ultra-luxury villas in Nueva Andalucía with interiors designed by Versace Home, offering panoramic views and wellness centres. The project is expected to launch in Q1 2025.

- St Regis The Residences: Spain’s first St Regis-branded residences at Finca Cortesín, offering 42 luxury apartments designed by Marcio Kogan. Completion is expected by 2026.

- Four Seasons: A luxury resort planned for the Rio Real area of Marbella, featuring a 5-star hotel, beach club, wellness centre, and residences. Launch date is yet to be confirmed.

- The W Marbella: A beachfront resort in Las Chapas, Marbella East, featuring a luxury hotel, beach club, and 124 branded residences. Launch date has not been confirmed yet.

As per Knight Frank’s ‘Branded Residences Report’, buyers of branded residences are usually willing to pay a premium, which are typically between 25 to 35% compared to a non-branded property. Services and amenities provided are the top reasons behind the purchase of a branded residence, followed by high yield/investment potential, maintenance and management, brand identity, and lock-and-go options.

Design trends

Having launched into minimalist white modernism a little over a decade ago, resulting in a proliferation of what many have come to somewhat derisively call ‘white boxes’, the trend has for the past few years evolved away from white to more earthy tones, together with the use of materials such as wood and stone – both indoors and outside, as well as the combination of Arabic-style tiles that blend well with a modern interpretation of traditional Andalusian architecture. One senses that we have now arrived at something of a point of inflexion, where the market continues to evolve along the ‘earthy’ route but is also open to elements of the region’s traditional architecture, both in terms of design, the application of technology and perhaps even the configuration and type of property.

It is also refreshing to see that both property owners and developers are more prepared to break away from the norm in terms of design and we are now witnessing more projects with fresh architectural styling than we have been accustomed to for some time.

The Economy

Marbella in the spotlight.

With property sales and tourist numbers remaining strong – this year the Costa del Sol is expected to set yet another record high for visits – the local economy continues to perform well. Marbella has topped the ‘Best European Destinations 2024’ list, based on votes from over one million travellers from 172 countries. It’s the first time a Spanish destination has ranked first.

Marbella is prominently featured in Knight Frank’s European Lifestyle Report 2024, standing out as a top destination for high-net-worth individuals (HNWIs). It ranks fifth in the Economy category of the “European Lifestyle Monitor,” which evaluates 20 leading European locations across key metrics.

The region often behaves independently from the national economy, but the latter is also among the stars within the European Union, expected to grow by around 2.4% in 2024, a factor that is reflected in strong inward capital flows into the Iberian peninsula. Andalucía is performing even better, leading growth in Spain with a 3.2% rate, according to the information from the Andalusian Government.

Internationally, the recession predicted by some appears not to have materialised as yet, and as we proceed further into the year may not happen during 2024. Growth is slowing down a little, along with inflation rates, but especially within the EU the prospect of reduced interest rates could at first weaken the euro but ultimately stimulate investment and economic growth through the easier and cheaper supply of credit.

The spectre of geopolitical instability doesn’t appear to negatively impact our region, as it draws people to this safe haven, a process we witnessed in the aftermath of war erupting in Ukraine. In all, the growing population of Málaga province also stimulates economic growth but this has to be balanced with investment in much needed infrastructure, and in that regard the region has a mixed but mostly tardy reputation that is the product of a culture dominated not by entrepreneurs and business-friendly officials but by a large and unwieldy army of highly bureaucratic functionaries.

Another possible problem facing this coast is the shortage of affordable housing, an issue that makes it increasingly difficult to attract staff for anything from construction and hospitality to the healthcare, tourism, educational and commercial sectors. Again, one would look to the municipal and regional authorities, but for now no solutions are forthcoming other than the Spanish government’s impending scrapping of the Golden Visa arrangement. While the disappearance of this scheme will have an impact on the market, its influence has thus far been limited to facilitating the purchasing of properties among a middle cadre of non-EU buyers.

Perhaps of greater importance for the local economy is the fact that non-EU citizens, including the British, cannot stay within the EU for more than 90 days in a row within any 180-day period. This is known as the Schengen 90/180 day rule, and it does limit easy access to Spain, but as a factor affecting the market it is offset by the growing tech presence in Málaga, which is now spreading along the Costa del Sol in coworking centres, investment initiatives and specialist businesses setting up, creating new jobs, capital inflows as well as bringing in a new type of resident, linking our region to the world through corporate business and also opening up new air routes, particularly with North America.

The new tax rules under Spain’s ‘Start-up’ Law, effective from January 2023, which offers tax incentives and streamlined procedures for digital nomads and start-ups, have made Marbella an even more attractive destination, boosting demand in the real estate market as more remote workers and entrepreneurs move to the area.

The Industry

Increased calls to regulate the industry

The property sector on the Costa del Sol has enjoyed some of its finest, most buoyant times over the past two years, and while things are slowing down a little it continues to be a strong driver of the economy. In general, it is ‘business as usual’, though many agents and industry professionals have become noticeably younger and today’s marketing techniques increasingly involve digital promotion, social media, video production, influencers and even strategies inspired by Hollywood TV series such as ‘Chasing Sunset’.

In the absence of official regulations to govern real estate practices, there have been increasing calls to professionalise and regulate the industry, returning to a system of registered agents with vocational qualifications that are required to adhere to certain codes of practice and conduct, including a more consistently professional and ethical approach and greater liability for their actions. The calls have mainly come from within the industry itself with a growing number of established agencies forging alliances and collaborations to establish frameworks for ethical practices in what is a drive for the industry to regulate itself. Locally, this led to the creation of a real estate association called the LPA - Leading Property Agents, which groups a growing number of real estate agencies looking to work and collaborate with like-minded companies who share a code of conduct and ethics when it comes to real estate practices. The initiative was undertaken by 11 founding members - including DM Properties - and it has since grown both in membership and reputation, adding weight to its stated objective to encourage a transparent, cooperative, professional and customer service-driven property sector.

What could we ‘wish’ for?

Healthy, sustainable growth.

There is much to be grateful for if you have been a real estate agent or property developer on the Costa del Sol since the end of Covid, but looking ahead, are there any measures or circumstances we could secretly hope for?

What comes to mind is of course continued demand, coupled with a sustainable (therefore slowing down) rate of price increases, a certain measure of regulation for the sector, along with the approval of the much- awaited new urban plan for Marbella to finally tackle problems surrounding traffic, parking, water supply and related infrastructural issues. In the wake of its growth, our region needs new public and leisure amenities, and not just in the form of the new hotel projects that are arising along the coast.

Good signs of growth and development in the area are the continued expansion of the coastal pathway and green zones, the works being carried out to create fluvial parks, and the expansion of educational, medical, sports and recreational facilities across the region, including of course the large new Starlite concert facility announced near Estepona.

In terms of stock to sell, we could hope for the continuation of exciting new projects that offer creative design, details and amenities combined with increasingly energy efficient and sustainable credentials, as well as quality living environments. Above all, we hope for a combination of factors that will enable a maintained level of healthy, sustainable growth.

Key Findings

A promising 2025.

- 2024 Sales: Sales in the Golden Triangle have accelerated in the first half of 2024 showing a 5.4% increase over S2/2023 and a year-on-year increase of 3.16%. This sustained upward trend reflects strong demand for properties in this prestigious area. The data suggests a stable and growing interest in the region, potentially driven by continued investment appeal and desirability among buyers.

- Buyer profile: Foreign demand remains strong with over 30% of property purchases in Málaga province made by foreign buyers in the first half of 2024. British buyers continue to lead the market with approximately 15% of market share. Younger buyers attracted by remote working and digital nomad visas.

- Consumer Preferences: Buyers are increasingly seeking modern, high-quality properties with advanced amenities, sustainability credentials, and branded residences. Growing number of small developers looking for refurbishment projects.

- Property Types: Apartments remain the most popular property type sold in the Golden Triangle, even though the interest in villas in our area remains higher than in other regions. Resale property continues to dominate the market in our area.

- Construction and Supply: New developments are in high demand, but supply has struggled to keep up. Rising construction costs and delays have impacted the market, with prices per m2 rising significantly.

- Price Evolution: Property prices continue to rise, with significant increases in the Golden Triangle. Despite this, there is no immediate risk of a market bubble.

- Market Trends: Interest rates are expected to decrease further, which may positively affect the market. Mortgage issuance in Spain has surprisingly increased despite high interest rates.

- Economic Outlook: The local economy is strong, with Marbella ranking first in the ‘Best European Destinations 2024’. Despite Geopolitical instability in eastern Europe, the region continues to attract buyers.

- Industry Developments: The real estate sector is pushing for professionalisation and regulation. More established agencies are focusing on the upper market segment.

- Wish List: Desired improvements include sustainable growth, better infrastructure, new urban planning in Marbella, and continued development of public amenities and green spaces.

Contributors and Research:

Pia Arrieta: Managing Partner

Mariano Beristain: Sales Director

Mar Poza: Marketing and Research Manager

Written by:

Michel Cruz