Selling Marbella Property

The ultimate guide to property selling in Marbella and Spain.

Maximize your property's selling potential with our experience and global reach

As a company specialised in selling prime luxury property in Marbella since 1989, we have a sales track record including some of the finest and most significant properties in the Marbella area. Our international reach and relations allow us to market properties listed with us to a global audience both openly and privately.

The marketing we offer for properties listed with us, is aimed at ensuring your property is presented in the best possible manner to secure a sale in as short a period as possible.

In order to help you get started we have listed below everything you will need to know about placing your property on the market, pricing, choosing an agent, the sales and marketing process and finally the expenses and taxes you will have to pay when finally selling.

If you are thinking of selling your property in Marbella, we would love to hear from you and advise on the best marketing tools available for your property as well as pricing. Get in touch today!

- Table of contents

- Maximize your property's selling potential with our experience and global reach

- The Complete guide to selling a property in Marbella

- 1. Pricing your property to sell

- 2. Appointing a real estate agency

- 3. Placing your property on the market

- 4. Taxes when selling your property

The Complete guide to selling a property in Marbella

1. Pricing your property to sell

Once you have decided to sell your property you will ask yourself what price you can achieve. You probably have an idea of the value of your property, know what your neighbour has sold their house for, how much it would cost to build a new property like yours (replacement value) or you may also be aware of prices being asked for properties similar to yours in comparable locations. All these considerations are useful in determining the price you may request for your property.

Market Appraisal

If you decide to engage the services of a real estate agent, they will estimate the replacement value of your property and its present market value. They will use examples of comparable properties being offered for sale at that moment in time and those which have been recently sold. The more information your agent has on real final selling prices of comparable properties the more accurate their valuation will be. Real final selling prices in Spain are not publicly available unfortunately, therefore an agent with a good track record in selling in the area will handle more reliable information to compare with. We cannot just go by asking prices to compare, as more often than not, these will vary significantly from the final selling price. In case of discrepancy between your estimated value and that of your agent, we always recommend obtaining an official valuation from an independent firm of valuers (such as Tinsa or Gevasa).

Deciding on the right price is important in order to reduce the time your property will be on the market and therefore not overexposing it. Waiting, in order to obtain a higher price means the property runs the risk of “going stale” if it is too long on the market, producing the opposite effect: Buyers tend to make low offers when a property has been on the market for a long time. In determining the asking price you must also bear in mind that most clients buying a property in Marbella will use it as a second or third home therefore have no urgency in acquiring a new home.

The price you request for your property, known as the asking price, should include the agent’s fees (typically between 5% and 6% plus VAT in the Marbella area) as well as some room to allow you to consider an offer somewhat inferior to the price, as it is rare for a buyer to make an offer for the full asking price in our market.

Official Valuations

If on the other hand you decide to instruct an official valuer, the following are the techniques they will use to carry out the valuation of your property:

Maximum legal value: The maximum sales price of a property, which is subject to the controls of subsidized housing.

Replacement cost: The total required investment to reconstruct the property with the same characteristics. The physical and functional depreciation of the property are variable and must be taken into account in the calculation.

Market value: The net value that could be expected to be achieved by a seller for the sale of the property at the time of the valuation, by means of proper marketing and assuming that there is a ready, willing and able purchaser. It also assumes that both the seller and purchaser are acting under their own free will.

Calculating market value: The legislation also defines the distinctive methods that can be used to calculate the market value: Comparative market analysis, fixed residual value, and capitalization of the current income yield. Other methods such as the dynamic residual value and the capitalization of projected income yield are more complex, since they introduce the parameter of time.

Comparative market analysis: This is based on the principle of substitution, in which the value is calculated from the recent sales of properties with similar characteristics although here the valuer will consider asking prices and not final selling prices.

Fixed residual yield: The method of fixed residual value is based on the principle of greatest and best use, taking into account that the property will have to adapt to changing conditions, provided that it is economically viable, to obtain the optimum and most intense use possible that evolves in its specific sector of the market in accordance with the location and planning characteristics.

Capitalization: The final method, capitalization of the current income yield, is defined as the price that an average investor would pay for the acquisition of a property in function of the expectations of the yield derived from its exploitation.

Life span: The life span is determined in function of the type of property: Residential property has an estimated life span of 100 years; offices have 75 years; commercial buildings have 50 years and 35 years for industrial premises. The valuations are normally made on the constructed area of the properties, and therefore it is important to have the right measurements. Frequently, the built area indicated in the title deed does not reflect the real area, either because it originally failed to include all the construction, or because there have been extensions made later and not incorporated into the Land Registry.

2. Appointing a real estate agency

Real Estate industry in Spain - Unregulated playing field.

The real estate industry in Spain is not regulated like in other parts of the world. For example, you do not need a real estate license to practice real estate in Spain. This unfortunately creates an ideal scenario for pseudo agents to incur in unprofessional activities and mis inform clients about their real estate investments.

There are hundreds of real estate agents in the Marbella area, some with offices and a team of professionals, others are freelancers working out of their homes, with no real infrastructure. Therefore it is important that you appoint someone that has been practising real estate for a considerable amount of time, has a proven track record, is relatively well known and most importantly you can get references about, from for example your bank manager or your lawyer.

What should I consider when choosing which agent to appoint?

Be it an established company, with an office and a good team in place, or a trusted freelance agent, your agent should be able to openly discuss the pros and cons of your property, and you as to how to make it look at its best for viewings, help you set a realistic price via an informed appraisal with the use of comparables, and offer a comprehensive range of marketing tools which will give your property the best reach and exposure within a set time frame and to an international clientele. Around 80% of property buyers in Marbella are foreigners so appointing an agent who can tap into those foreign markets is key in helping to source a potential buyer sooner rather than later.

These questions can help you to decide on which agent/agents to appoint:

- Is the agent well known in Marbella and do they have a good reputation?

- Does the agent have experience in selling properties similar to mine or in the same location?

- Does the agent offer international marketing and what channels do they use for this?

- Does the agent have an overseas team helping to source clients in the potential buyer’s country?

- What infrastructure does the agent have and what can they offer? I.e do they have an office with a team of professionals or is it a one man band working from home?

Should I appoint 1 or several real estate agencies to sell my property?

Let’s have a look at the pro’s and con’s of each.

Appointing several agents:

From the owner’s point of view it would seem as the best way to go about selling your property: The more agents involved, the higher the chance of finding a buyer. Also consider, you will have to handle client registrations for all agencies involved, organise access to the property for all agencies’ viewings with clients (or have someone do this for you), and be receiving feedback on viewings and marketing updates from all.

Let’s say you finally appoint 5 agents, all with the same conditions and standard commission of 5% plus VAT. Each agent would carry out their own photography and video or you can choose to cover this cost yourself and provide the material to all agents so they are all presenting the property in the same way. Each agent would then be using their marketing channels to try to source a buyer and would also be using their network of local agents with the hope that one of them may have a buyer (when splitting agent fees, the agencies involved in the sale would then usually earn 2.5% plus VAT of the final selling price).

From the agent’s point of view, when you are instructed as one of many agents, you know the more agents appointed, the lower the chances are of you selling the property. Hence, any money invested in the production of the audiovisual material and/or marketing may not have its returns. Depending on the type of property, price and therefore likelihood of selling within a reasonable time frame (usually within 12 months) the agency will evaluate how much or how little they spend on marketing for your property. Additionally there may be certain marketing tools available which are only used for properties that the agent handles exclusively (sole agent).

Appointing 1 agent:

This will mean you just have that 1 agent as your one and only point of contact for everything related to the sale of the property. Your appointed agent will be in charge of handling all viewings and client registrations/feedback and access to the property, be it their own clients or clients brought by a collaborating agent.

The agent appointed as sole agent will have that extra motivation and will be much more willing to spend money and time on marketing, in order to sell the property before the end of the sales mandate.

Regular marketing and viewing feedback from your agent is essential to ensure that they are not just sitting back and waiting for a client to appear, now that they have a sole agency appointment, but rather are taking an active role in trying to source the buyer both locally and internationally.

3. Placing your property on the market

It is important to examine your property critically and to be objective about its weak points. Here is where your real estate agent must advise you in the cold light of facts. Walk around the property with your agent. If he is a good professional, he will point out the negative features and make suggestions on how to improve them. He will tell you to fix those faulty things, maybe giving a coat of paint or redecorating some of the rooms or even undertaking some renovation if this is advisable. Repair those ugly damp patches or cracks on the walls. If the walls or ceilings are in need of paint, paint them! Remember that the first impression counts. If a property is badly maintained the chances are the buyer will make a lower offer due to possible necessary renovations in the future.

Consider some renovation or making a few changes if you think that most buyers will like them. Remember that some buyers will not have the time or do not want to get involved with builders. This can be a reason for not purchasing your home.

If you think that your changes may not be to everyone’s taste, ask your agent to advise you. For example, if your house needs a new kitchen and you are afraid that a buyer may not like it, then, do not buy one. However, you must then take into consideration the money and time the new owner will have to spend on a new kitchen. Do not hide defects or faults. Try to repair them.

Make your property look attractive and cosy. Most people like light and well-lit houses. Change those old light fittings in the bathrooms, which give very little light and make them look dark and gloomy. Sometimes a few spotlights can do wonders. Replace the stained old taps for new ones. You will be surprised to see how little money this will cost and how much better your bathroom will look.

Get ready for the sale. Have all the documents at hand, so when the moment comes, you can hand over copies of your title deed, first occupation licence, receipts for payments of all taxes and running expenses, including community fees and your house staff. Do not wait until the last moment to get your paperwork in order and your bills paid.

4. Taxes when selling your property

(updated in May 2025)

The expenses that an owner has to face at the time of sale are:

- Real estate agent’s fees.

- Property expenses.

- Taxes.

Estate agent’s fees:

Agency fees are usually a percentage of the sale price and can vary according to the agency and according to the price of the property. On the Costa del Sol this is usually around 5% of the sale price plus VAT. In most cases the commission is paid by the owner, (although it can also happen that a buyer hires the services of an estate agent to search for a property and negotiate the purchase. In this case, which is not so common, the commission will be paid by the buyer).

Property expenses:

The property expenses comprise of I.B.I (municipal tax), rubbish, community expenses, electricity, water, telephone, etc. until the day on which the public deed of sale is signed in favour of the new owner. In the event that these expenses cannot be accurately calculated on that date, the buyer or his legal representative may withhold from the final payment an amount to cover them.

Taxes on the sale of a property:

Plusvalía Municipal:

The plusvalía municipal is a tax on the increase in the value of the land since the last transfer. Since 1 January 2013, it is compulsory to present proof of payment of the plusvalía in order to register the sale and new ownership in the Land Registry. Likewise, it has been recently modified according to Royal Decree-Law 26/2021 of 8 November and although the non-obligation of its presentation in the case of a sale at a loss is maintained, there are two important new features:

1.- Sales made within the first year of ownership of the property are now subject to taxation.

2.- Two calculation formulas are established and the taxpayer will choose the most convenient one:

- a. Objective system (similar to the old one). The taxable base will be determined by the cadastral value of the land and the years of ownership.

- b. Direct estimation. Here the taxable base is determined on the basis of the purchase and sale prices, the years of ownership and a reduction coefficient that can be applied by each Town Hall with a maximum of 15%.

Even though the taxpayer can choose the most favourable option, it should be noted that once the taxable base has been determined, the local councils have regulatory freedom in terms of the tax rate to be applied (maximum 30%) and the allowances (maximum 95% of the tax liability).

Income Tax:

Non-residents: When a non-resident sells a property in Spain, he/she is obliged to pay a tax based on the profit obtained from the sale (the difference between the sale price and the purchase price plus all expenses, including improvements to the property). This is the Non-Resident Income Tax (IRNR) and is payable at a flat rate of 19% of the tax base if resident in the EU and 24% in all other cases. The law provides that the buyer must withhold 3% of the sale price of the property and make a deposit on account of this amount with the State Tax Administration Agency to ensure collection of the tax. If the 3% withholding is higher than the tax payable, the seller is entitled to claim a refund of the overpayment. If, on the other hand, the withholding is less than the total tax due, the difference must be paid to the tax authorities within 4 months of the date of sale.

Residents: If the seller is a tax resident or a company that pays its taxes in Spain, the 3% withholding tax will not be levied.

Natural person, tax resident: in this case, at the time of making the tax return, you will pay a progressive rate ranging from 19% (on the first €6,000) to 28% for profits exceeding €300,000.

Spanish limited company: Spanish limited companies are currently taxed at a rate of 25%. From 2024, a progressive reduction in the tax rate is being applied, but this does not affect property holding and/or rental companies. It would only apply if they carry out a main economic activity.

Exemptions/Payment deferral:

Over 65s who sell their permanent residence are exempt from payment of personal income tax. To be considered ‘permanent residence’ it must be the person’s habitual place of residence and owned for a minimum of 3 years prior to its sale.

Reinvestment in property within a maximum period of 24 months: The gain obtained on the sale of the permanent residence is exempt from taxation as long as it is reinvested in a new property within the two years prior to and/or after the date of sale (taken from date to date).

Please do not hesitate to contact DM Properties | Knight Frank for further information and we always recommend that you consult a qualified professional to plan your investment from a legal and tax point of view according to your personal circumstances once you have found the property of your dreams and before completing the transaction.

The contents of this guide are for information purposes only; they are subject to errors, omissions or changes and should not be considered a substitute for the advice of a legal and/or tax professional. Accuracy is not guaranteed.

Our exclusive listings in Marbella

Beachside villa for sale in Carib playa

€3,590,000

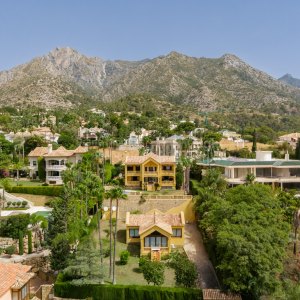

Casa Bach - Elegant villa with sea views in Sierra Blanca, Marbella

€5,500,000 Under offer

Villa Ambar, a high quality house in Sierra Blanca

€7,300,000 Under offer

Pia Arrieta Principal Partner

Call now, ask via whatsapp or fill the contact form and we will get back to you asap.