Marbella Property Market Price Trends 2025-2026

Price trends say a lot about the state of a real estate market. Beyond just indicating average sales prices, values per square metre and how these have been trending up or downwards, they also provide a valuable insight into the dynamics that have been driving the market and most importantly, where it’s headed next.

Property price trends primarily involve the selling price of homes but you can also expand the analysis to look at land values and the cost of construction – i.e. the factors that influence the supply side of housing. Add to this the dynamics of demand and you arrive at the final purchasing price, which in turn reveals the current average value of homes in particular areas.

Spanish price trends

The chart of average home prices in Spain accurately tells the story of both the country’s property market and economy in general, starting with an average price/m2 of €1000 in 2002 and rising through the credit-fuelled boom of the 2000s to a 2008 high of €2200/m2 before falling after the Financial Crisis impacted the market. Spain was one of the countries most affected exactly because it had been building so much, and it took another eight years for real estate to bottom out at a post-boom low of €1300/m2 in 2016 – after many other countries were already well on their way to recovery. [Source: Tinsa]

By 2020 prices had recovered to €1700/m2 and after some levelling off during the Covid period reached an average of €2091/m2 in 2025 – no less than 13,1% higher than the year before [Source: Tinsa]. This rapid (and recently accelerated) increase can be explained by demand outstripping supply, this itself the product of both domestic and external demand, or should we say competition. Having been rather weak for many years, the Spanish home market has rebounded on the back of higher employment and income levels, releasing a pent-up demand that is struggling to keep up due to a longstanding lack of homebuilding in normal residential areas and competition from foreign buyers and those investing in tourist accommodation. This in itself already indicates a somewhat skewed market in which a disproportionate amount of investment and construction has in recent years been concentrated on coastal destinations.

Costa del Sol Trends

One of these hotspots has been the Costa del Sol, and in particular the Golden Triangle of Marbella, Benahavis and Estepona. Over the years, we have seen that this region’s property market and indeed economy has often reacted differently to that of the rest of Spain, frequently by entering and especially recovering from recessions earlier. Historically, the region has entered recessions before the rest of Spain and recovered from them more quickly because it is more directly connected to international trends. With so many of its buyers coming from abroad, it responds more quickly to international influences than the national market, as was clear in the fact that the Costa del Sol recovered much more rapidly from the Financial Crisis than Spain in general. Today we see a similar picture to the national one, only more so, as property prices have grown more rapidly here since the end of the Covid period to reach an average of up to €5400/m2 in Marbella, €5000/m2 in Benahavis and €4000/m2 in Estepona. [Source: Portal Estadistico Notariado].

All have continued to see increases in average selling price over the past year with Marbella and Benahavis posting 5,57% and 4,29% increases respectively and Estepona 7,13% during 2025 [Source: Portal Estadistico Notariado]. They are the result of the interaction between supply costs (land and construction) and demand, which dictates the price that buyers are willing to pay. So, let’s have a closer look at those Golden Mile price increases.

Cost factors vs Demand

In recent years, and especially since the Covid Pandemic, the cost of producing properties on the Costa del Sol has risen considerably. The immediate post-pandemic period was marked by high inflation, shortage of building materials and long waiting times for their delivery. This resulted in rapidly rising construction costs and extended building times, further exacerbated by land values that have tended to rise more quickly than the end product. The result has been a tightening of developers’ profit margins, which has been alleviated by the ability of the market to absorb rising prices. More recently, with reduced inflation levels overall, building costs have largely levelled off and now stand at around €2500/m2 for standard quality and above €3500/m2 for premium quality.

Unfortunately, this is not the case for land prices, which due to scarcity and a high degree of competition among developers continues to rise rapidly, having risen from commonly below €500/m2 less than a decade ago to €1000-€1500 now. Much, of course, depends upon location, and though land is still available in parts of Benahavis and Estepona not all of it is (as yet) attractive to developers, pushing up the price of those relatively scarce plots that are in high demand even more. Overall, inflation has therefore dropped, building prices have largely reached a plateau and land values continue to rise, but developers have been able to pass any such cost increases on to a buying public that has so far been able to absorb it, thanks to a consistently high level of demand and the fact that high though they may seem to us, property prices on the Costa del Sol still compare favourably with those across much of Europe and similar resort destinations around the world.

Next Trends

The key question right now is if buyers will continue to absorb higher prices, and recent indications in the final half and quarter of 2025 have shown a significant slowing in pace:

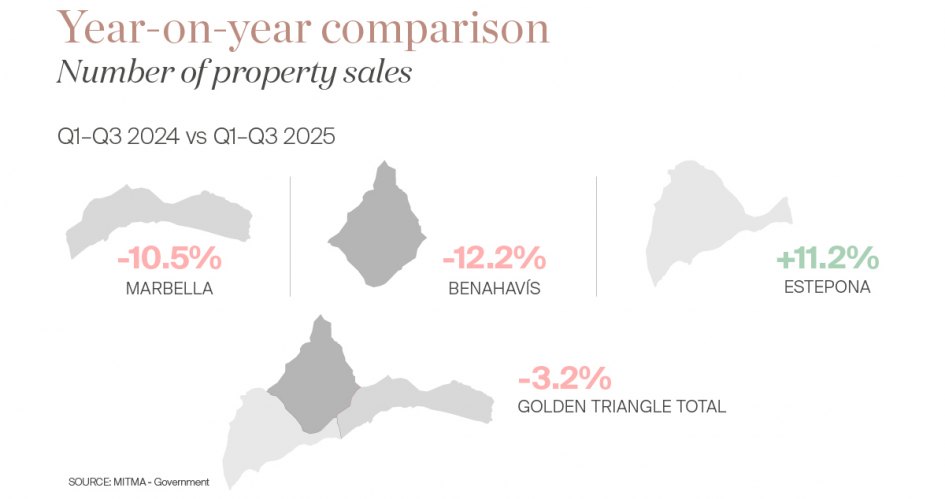

| PROPERTY SALES | Q1-Q3 2024 | Q1-Q3 2025 | TREND |

| Marbella | 3,589 | 3,213 | -10,05% |

| Benahavis | 614 | 539 | -12,2% |

| Estepona | 2,179 | 2,423 | 11,2% |

| GOLDEN TRIANGLE | 6,382 | 6,175 | -3,2% |

| Fuente: MITMA - Government | |||

The latest figures, which compare sales in the first three quarters of 2024 with those in the first three quarters of 2025, show a somewhat expected slow downward trend of -3,2% for the Golden Triangle, with Benahavís recording a decrease in sales of -12,2% and Marbella and Estepona approximately offsetting one another with a drop and increase of around -10,5% and +11,2% respectively.

Reduced demand would also begin to slow down the increase in land prices and allow the market to let off some steam. After several years of intense growth, with much new construction especially in Estepona and Benahavis but also Ojén and Mijas, a gentler pace of sales and easing of price increases may not even be such a bad thing for the market in the mid to longer term. Having become accustomed to such a buoyant market, the Costa del Sol property sector may have to adjust to a different pace for a while, but a recession is highly unlikely as the coast’s main drivers of intrinsic demand appeal and price competitiveness remain in place and this continues to be a greatly desired lifestyle destination for people across Europe and beyond.

Pia Arrieta, 19 Jan 2026 - Intelligence

Related Articles

Knight Frank Global Super-Prime Intelligence, Q4 2025

3 min. read · Pia Arrieta

Knight Frank: Global House Price Index Q3 2025

2 min. read · Pia Arrieta

Knight Frank’s Prime Global Cities Index, Q3 2025.

1 min. read · Pia Arrieta

Knight Frank’s European Outlook 2026: A Clear View of What’s Next for Europe’s Property Markets

2 min. read · Pia Arrieta